Why ASCIP Health Benefits

We Share Claims. Our self-funded program renewals are based on a blend of district-specific trends with the overall trends of the ASCIP pool. This approach not only yields greater rate stability, but also allows us to share available claims data and rewards districts that implement successful wellness, prevention and early detection programs.

We Share Claims. Our self-funded program renewals are based on a blend of district-specific trends with the overall trends of the ASCIP pool. This approach not only yields greater rate stability, but also allows us to share available claims data and rewards districts that implement successful wellness, prevention and early detection programs.

We Don’t Require 100% Participation. Many pools require all employees and dependents to enroll in their benefits programs. ASCIP assesses the long term risk of member districts using a variety of sources and can accommodate lower participation rates and waivers if enrollment is stable.

We Don’t Lock You In. Some pools require members to join for multiple years, or they create barriers to exit and re-entry. ASCIP allows members to exit at their next scheduled renewal date each year, and schools can re-enter the pool at any time.

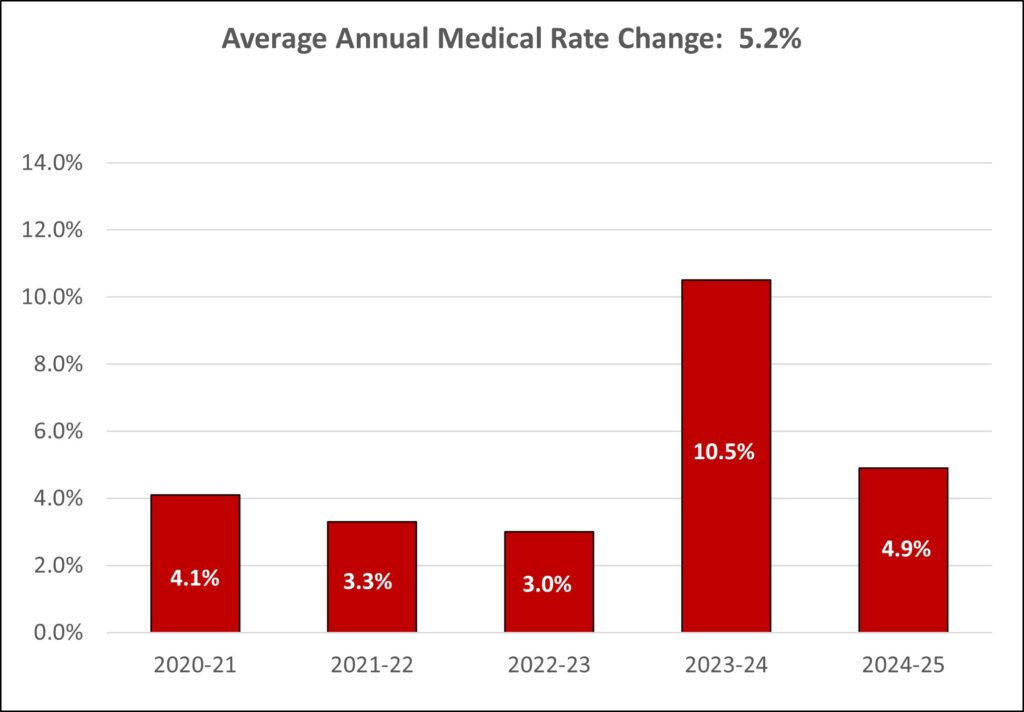

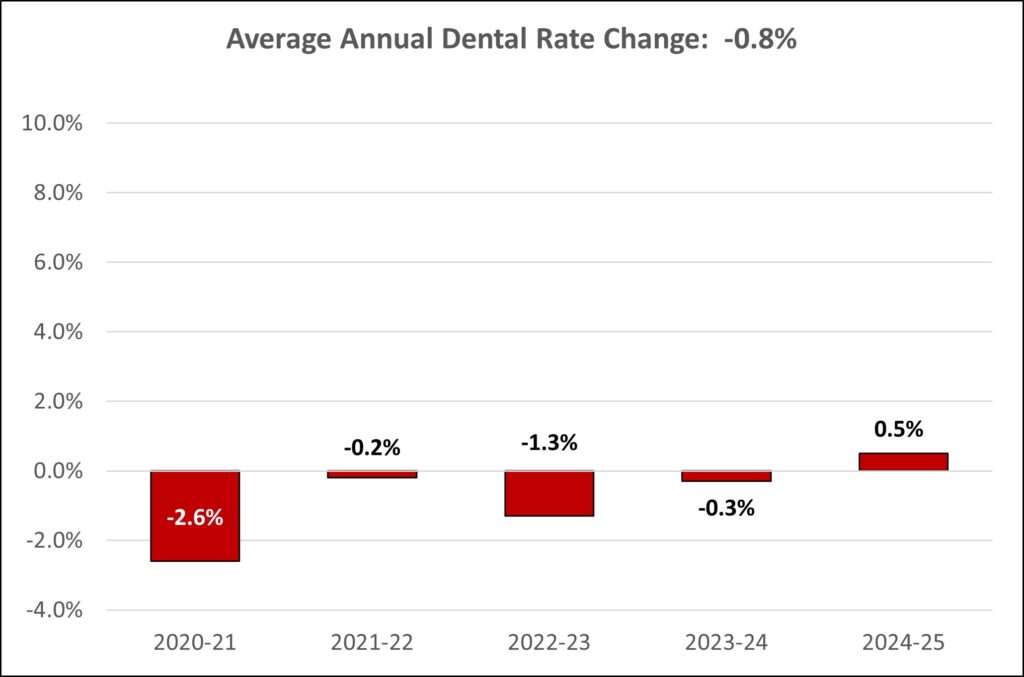

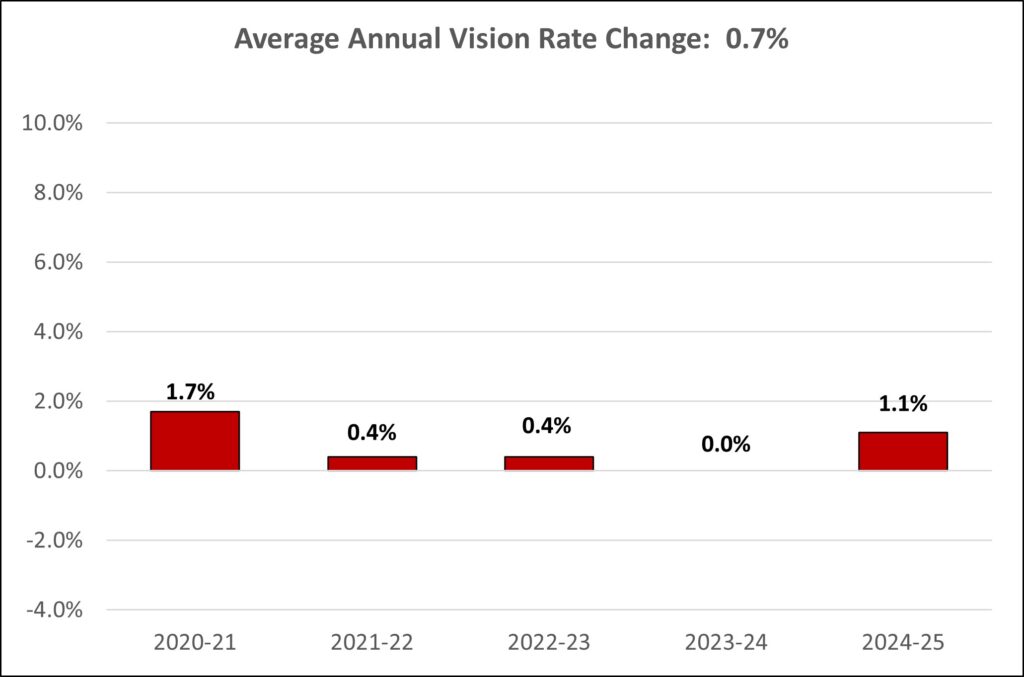

Rate Change History

The average rate change for the past 5 years is shown below.

Fully-insured Pools

Medical carriers assume the risk on the pools shown below. ASCIP negotiates rates with each carrier using the combined purchasing power of the pool in total.

| 5-Year Average Rate Change | |

|---|---|

| Kaiser | 2.90% |

| United Healthcare | 5.60% |

Products & Services

Medical

- Anthem – https://www.anthem.com/ca

- Blue Shield – https://www.blueshieldca.com/

- Kaiser – https://select.kaiserpermanente.org/ascip-jpa-microsite

- Navitus Rx – http://www.navitus.com/

- UnitedHealthcare – https://www.uhc.com/

Dental

- Delta Dental – http://www.deltadentalins.com/

- DeltaCare – https://www1.deltadentalins.com/individuals/plans/deltacare-usa.html

Vision

- Vision Service Plan (VSP) – https://www.vsp.com/

Life & Disability

- Voya Financial – http://foremployers.voya.com/

Other Products

Social Security Alternative Plans

ASCIP offers Member Districts a Social Security Alternative Plan (SSAP) that satisfies the OBRA requirements for comparable retirement plans offered to part-time, temporary and seasonal employees. The plan provides an option that is far less costly than the overall 12.4% contribution required under Social Security (6.2% from each, the employer and the employee).

Claims Concierge Services

ASCIP offers a unique service to help medical care consumers access the information needed to make educated and informed decisions about their treatment options.

How does it work? Simply call or email a Health Advocate for assistance in a variety of areas.

Find the right care: Get assistance finding quality in-network doctors and hospitals based on patient outcomes, procedure price, safety scores, experience rankings and patient satisfaction.

Resolve time-consumng issues: Let a team of experts do the work to research medical claim and benefit denial issues.

Drive more informed care decisions: An experienced care team can clarify diagnoses, research treatment options, and coordinate second opinions.

This program is discounted or free based on your participation in ASCIP’s medical plans. Contact ASCIP Health Benefits at (562) 404-8029 or hb_info@ascip.org for more information.

COBRA & Retiree Billing

We’re happy to announce the addition of COBRA and Retiree Billing administration to the suite of products and services offered through ASCIP. As you may know, COBRA and Retiree Billing administration is complex and cumbersome, and accidental non-compliance can result in substantial penalties. In response, ASCIP has negotiated reduced fees with a highly regarded third party administrator who’s an expert in these areas. The fees are discounted further based on your district’s participation in ASCIP’s Health Benefits programs.

Interested in reducing the burden on your benefits staff? Simply contact ASCIP Health Benefits at (562) 404-8029 for details.

ASCIP has partnered with a mental health and substance abuse care concierge team that makes it easier for staff and families to connect with behavioral health resources and providers in their communities. This 24/7 teamguides and suppport families though the entire process of acessing vetted providers, reducing wait times into care, navigating insurance coverage, and scheduling appointments.

Forms & Resources

Downloadable Forms & Resources

Please use the links below to download the corresponding documents.

Links

FAQs

ASCIP’s new business rates are customized to each Member based on demographics, locality, product mix, and premium contributions. This approach has contributed to ASCIP’s renewal rate stability over the last 10 years.

ASCIP offers a set of standard plans with several coverage options in order to provide a range of premium prices. Proposals are based on our closest matching standard plan, but benefits will not match exactly.

Districts can join any time, and will renew on either of the pool renewal dates of October 1 or January 1.

Districts can leave the pool at their next scheduled renewal date and are required to submit an exit notification on signed district letterhead at least 90 days prior. The exit notice is retractable, districts do not have to join the pool for more than one year and districts can rejoin at any time subject to underwriting approval.

Districts can choose to join just the medical, dental, vision or life & disability pools.

Yes, unlike most pools ASCIP can provide monthly claims and enrollment data on a quarterly basis upon request for our self-funded medical, dental and vision pools.

ASCIP is a non-profit risk pool that works collaboratively with brokers and with districts who do not have brokers.